An MSME (Micro, Small, and Medium Enterprises) License is a certification that registers a business as an MSME in India. This license is crucial for small businesses as it provides various benefits and support from the government. Here’s a brief overview of what the MSME License entails:

What is MSME?

Benefits of MSME License

How to Apply for MSME License

The MSME License is essential for small businesses seeking to grow and access various government benefits in India. Let me know if you need more information or specific details!

The Micro, Small, and Medium Enterprises (MSME) sector plays a crucial role in the Indian economy. Under the MSME Development Act, certain guidelines and regulations are in place to support small businesses. It’s essential to comply with these rules to benefit from government schemes and avoid any legal issues.

Operating without MSME registration can lead to missed opportunities for financial support and business growth. Additionally, unregistered businesses may not be eligible for government contracts or incentives that can significantly benefit their operations.

To ensure you take advantage of all the benefits available to MSMEs, it’s vital to complete your registration on time.

For quick and hassle-free MSME registration, visit bharatlicenseexpert.com and get your license today!

Aadhaar Card:

You need a copy of your Aadhaar card.

Business Address Proof:

Provide a document that shows where your business is located, like:

Identity Proof:

You need a valid ID, such as:

Business Registration Certificate:

If your business is registered, include its registration certificate (like a Partnership Deed or Memorandum of Association).

Bank Account Statement:

Show a recent bank statement or a canceled cheque from your business bank account.

Details of Investment:

Share information about how much money you have invested in your business, like:

Business Type:

Tell us what type of business you have (like a sole proprietorship, partnership, or company) and what you do.

Income Tax Returns:

If you have filed income tax, include your recent returns.

Easy Access to Loans:

MSME Certificate helps you get loans from banks and financial institutions at lower interest rates. This makes it easier to start or grow your business.

Government Schemes and Subsidies:

You can apply for various government schemes and subsidies that support small businesses. This can help you save money and get extra funding.

Tax Benefits:

MSME Certificate may allow you to enjoy tax exemptions or reductions. This means you pay less tax, which is good for your business.

Participation in Government Tenders:

Registered MSMEs can bid for government contracts and tenders. This opens up new opportunities to secure work and expand your business.

Protection Against Delayed Payments:

If a buyer delays payment, having an MSME Certificate gives you legal protection and helps you claim your dues more easily.

Better Market Access:

MSME registration can help you get recognition in the market, making it easier to connect with other businesses and customers.

Support for Technology Upgrades:

With MSME registration, you may get support for upgrading your technology and processes, helping your business become more efficient.

Credibility:

Having an MSME Certificate increases your business’s credibility. Customers and partners are more likely to trust a registered business.

Micro Enterprises:

Small Enterprises:

Medium Enterprises:

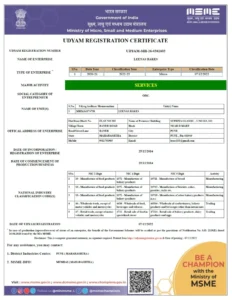

The MSME License (also known as Udyam Registration) is valid for a lifetime. Once you register your business, you do not need to renew it regularly.

However, if there are any changes in your business, such as:

You must update your registration to reflect these changes.

Remember, to keep enjoying the benefits of the MSME License, ensure that your business follows all government rules and regulations.

No MSME Benefits:

Without an MSME License, you will not be able to access various benefits offered by the government, such as:

Limited Market Opportunities:

You might miss out on government tenders and contracts that are only available to registered MSMEs.

Legal Compliance:

While you can operate without an MSME License, you still need to follow other laws and regulations related to your business, such as obtaining necessary permits or licenses (like FSSAI for food businesses).

Credibility:

Not having an MSME License may affect your business’s credibility. Customers and partners may prefer to work with registered businesses.

Future Growth:

If you plan to grow your business, getting an MSME License can provide you with the support and resources you need

No, MSME registration is not transferable. Here are the key points to understand:

Business Ownership:

The MSME registration is linked to the specific business owner or entity. If the ownership changes (like selling the business), the new owner must apply for a new MSME registration.

Changing Structure:

If you change your business structure (for example, from a sole proprietorship to a partnership), you will need to register as a new MSME.

Updating Information:

While the registration itself cannot be transferred, you can update your MSME registration with new information, such as changes in business name or address.

Compliance:

It is important to comply with all regulations and complete the registration process correctly when ownership changes to avoid any legal issues.

An MSME License, also called Udyam Registration, is a special certificate for small and medium businesses in India. It shows that your business is recognized by the government as a Micro, Small, or Medium Enterprise (MSME).

When you have this license, it opens up many doors for your business. You can get easier loans with lower interest rates, access to government help and schemes, and even some tax benefits.

To get the license, you just need to fill out an online form and provide some documents about your business. Once you have the license, it doesn’t expire, so you don’t have to worry about renewing it every year.

Having an MSME License also makes your business look more trustworthy to customers and partners. It helps you stand out in the market.

In short, if you own a small or medium business, getting an MSME License can really help you grow and succeed.

Getting an MSME registration comes with several advantages that can help your business grow:

Easier Access to Loans:

With an MSME registration, banks and financial institutions are more likely to offer you loans with lower interest rates. This makes it easier to get the funds you need for your business.

Government Support:

Registered MSMEs can take advantage of various government schemes and subsidies. This support can help you save money and grow your business faster.

Tax Benefits:

Many registered MSMEs enjoy tax exemptions and reductions. This means you can keep more of your hard-earned money to reinvest in your business.

Better Market Opportunities:

Having an MSME registration allows you to participate in government tenders and contracts, giving you a chance to work on bigger projects.

Credibility and Trust:

An MSME registration helps build trust with customers and suppliers. It shows that your business is legitimate and committed to following regulations.

Protection Against Delayed Payments:

The MSME Act provides protections for businesses against late payments from buyers. This means you have more security when it comes to getting paid on time.

Skill Development:

MSME registration can give you access to training programs that help you and your employees improve skills and knowledge, making your business stronger.

In summary, getting your MSME registration can provide your business with valuable benefits, making it easier to grow and succeed in today’s competitive market.

Getting a basic MSME registration has many advantages for your business:

Access to Loans:

With MSME registration, banks are more willing to give you loans at lower interest rates. This makes it easier to get money for your business needs.

Government Help:

You can access various government schemes designed to support small businesses. This help can include financial assistance and other resources to help you grow.

Tax Benefits:

Registered MSMEs often enjoy tax reductions and exemptions, allowing you to save money that you can use to invest back into your business.

Credibility:

Having an MSME registration makes your business look more trustworthy. Customers and suppliers are more likely to choose you when they see you are registered.

Market Opportunities:

You can participate in government tenders and contracts that are only open to registered MSMEs. This gives you a chance to work on larger projects.

Protection from Late Payments:

If you register your MSME, you get legal protection against delayed payments from buyers, helping you maintain cash flow.

Skill Development Programs:

You may also get access to training programs to help you and your employees develop new skills, making your business more competitive.

In short, registering your MSME can provide valuable benefits that help your business grow and thrive in the market.

You should apply for an MSME license if you own or plan to start a small or medium-sized business in India. Here are some specific situations when you should consider getting the license:

Starting a New Business:

If you are starting a new small or medium enterprise, it’s a good idea to apply for the MSME license right away. This will help you take advantage of government schemes and benefits from the beginning.

Expanding Your Business:

If your business is growing and you plan to invest more in it or hire more employees, getting an MSME license can provide you with additional financial support and resources.

Seeking Loans or Financial Aid:

If you need a loan or financial help from banks or government programs, having an MSME license will make it easier to access these funds.

Participating in Tenders:

If you want to bid for government contracts or tenders, you must have an MSME license. This registration allows you to compete for larger projects.

Meeting Legal Requirements:

If your business falls under the micro, small, or medium categories as defined by the government, you need to apply for an MSME license to comply with legal regulations.

Taking Advantage of Benefits:

Whenever you want to access the various benefits offered to MSMEs, such as tax exemptions or subsidies, having the license is essential.

In summary, you should apply for an MSME license as soon as you start or plan to grow your business, seek financial aid, or participate in government tenders.

Getting an MSME license is a straightforward process. Here’s how you can apply:

Visit the Official Website:

Start by going to the official MSME registration website. You can find it at bharat licence expert

Create an Account:

You will need to register by creating an account. Provide your basic details like your name, email, and mobile number. You will get an OTP (One-Time Password) for verification.

Fill Out the Application Form:

After verification, log in to your account and fill out the application form. You will need to provide information about your business, such as:

Upload Documents:

Attach the required documents. These may include:

Submit the Application:

Once you have filled out the form and uploaded the documents, review everything for accuracy. Then, submit the application.

Receive Acknowledgment:

After submission, you will receive an acknowledgment receipt with a unique registration number. Keep this for future reference.

Verification by Authorities:

The MSME authorities will review your application and documents. If everything is in order, your MSME license will be processed.

Receive Your MSME License:

Once your application is approved, you will receive your MSME license via email or on the portal. You can download and print it for your records.

In summary, the process to get an MSME license involves registering online, filling out an application, uploading documents, and waiting for approval. It’s a simple way to get your business recognized and enjoy its benefits.

If your MSME registration application is canceled, don’t worry! Here’s what you can do:

Check the Reason for Cancellation:

First, find out why your application was canceled. You can usually find this information in the notification sent to you by the licensing authority. Common reasons may include:

Gather Necessary Documents:

If the cancellation is due to missing documents or incorrect information, collect the required documents and correct any mistakes in your application.

Contact the Licensing Authority:

Reach out to the relevant licensing authority or their helpline for guidance. They can provide specific details about why your application was canceled and how to resolve the issues.

Reapply for Registration:

After addressing the reasons for cancellation, you can reapply for MSME registration. Make sure to provide all the correct information and include the necessary documents this time.

Follow Up:

After reapplying, keep track of your application status. You can check online on the official MSME registration portal or contact the authority to ensure your application is being processed.

Seek Professional Help:

If you find the process confusing or challenging, consider seeking help from a professional or consultant who specializes in MSME registration. They can guide you through the process and help you avoid mistakes.

In short, if your MSME registration application gets canceled, check the reason, correct any issues, and reapply. Stay in touch with the licensing authority to ensure a smooth process.

Yes, it is important to apply for MSME registration when starting a new business. Here’s why:

Access to Benefits:

Registering your business as an MSME allows you to access various government benefits and schemes, such as subsidies, tax exemptions, and easy loans. These can help your business grow.

Credibility:

Having an MSME registration adds credibility to your business. It shows customers and suppliers that you are a legitimate business, which can help build trust.

Financial Support:

If you need financial help, many banks and financial institutions prefer lending to registered MSMEs. This can increase your chances of getting loans or financial assistance.

Tenders and Contracts:

If you want to participate in government contracts or tenders, having an MSME registration is often a requirement. It allows you to compete for larger projects.

Legal Compliance:

In many cases, the government requires businesses to register to comply with legal regulations. Having your MSME registration in place ensures that you are following the rules.

Protection of Rights:

MSME registration provides protection under various laws. It helps safeguard your business rights, ensuring that you can operate without fear of unfair practices.

WhatsApp us